Real estate is one of the most valuable industries in the U.S., with its value projected to reach about $119.80 trillion by the end of 2024. It is also one of the most lucrative industries, and the biggest players boast profit margins of billions of dollars.

However, real estate is also somewhat complex, and many people don’t fully understand how it works. Here is a brief guide on what real estate is all about.

What is Real Estate?

Real estate refers to land and any permanent structures on it, including natural and man-made ones. Common examples of natural real estate structures include trees, while man-made ones include buildings and related infrastructure, such as drainage and sewerage systems.

Types of Real Estate

The real estate industry and assets are broad and categorized into the following five types:

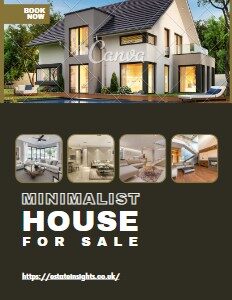

· Residential Real Estate

Residential real estate refers to property used for residential (living). Common types of residential real estate properties include single-family houses, multi-family homes, condos, duplexes, apartments, and townhouses.

· Commercial Real Estate

Commercial real estate refers to land and property used exclusively for working and generating income. Common types of commercial real estate include retail shops, grocery stores, restaurants, hotels, hospitals, and office buildings. Interestingly, at least five residential rental properties owned by a single entity are also considered commercial real estate.

· Industrial Real Estate

Industrial real estate refers to land and properties used for manufacturing activities, such as production, storage, distribution, and research and development. It is similar to commercial real estate in that it is meant for generating revenue and making profits. Common types of industrial real estate include farms, warehouses, factories, and mines.

· Land Real Estate

Undeveloped land also qualifies as real estate. Interestingly, it is the most versatile type of real estate because you can develop different types of property in it, such as residential and commercial properties.

Moreover, you can use it for various industrial purposes, such as farming and mining. Notably, land also appreciates over time and through improvements such as construction, making it a strategic real estate investment.

· Special Purpose Real Estate

Special purpose real estate refers to land and properties used by the public. Common examples include parks, cemeteries, schools, and government buildings.

Working in Real Estate

Real estate is one of the largest job markets in the U.S., currently employing over two million people. Notably, most people working in the industry work as real estate agents and brokers. They help buyers and sellers with most aspects of real estate transactions, such as finding leads, valuing, negotiating prices, and completing the required paperwork.

Other common types of real estate jobs include the following:

- Property Managers

- Leasing Agents, Consultants, and Administrators

- Home Inspectors and Appraisers

- Mortgage Brokers and Processors

- Escrow Officers

- Property Developers

- Real Estate Investors

The various real estate professions have varying requirements and qualifications. For example, real estate agents must complete pre-licensing classes and pass licensing examinations.

Investing in Real Estate

Real estate offers lucrative and highly rewarding investment opportunities. Notably, individual real estate investors can make tens to millions of dollars, while institutional investors can make billions.

You can invest in real estate in various ways. The most common investment strategy involves developing or buying residential or commercial property to rent, lease, or sell. However, this investment strategy requires a lot of capital, leaving many people thinking that only high-net-worth individuals can invest in real estate.

However, while the capital requirements for some real estate investment strategies are high, others are conveniently affordable, including the following:

- Real Estate Investment Trusts (REITs)

- Real Estate Investment Groups (REIGs)

- Real Estate ETFs & Mutual Funds

- Crowdfunding

Overall, buying shares in REITs and investing in REIGs, ETFs, and Mutual Funds are the cheapest and easiest ways of investing in real estate. Notably, REITs are publicly traded and share 90% of their profits with investors. However, it is also worth noting that there are many other real estate investment strategies, and each has its advantages and shortcomings.

Conclusion

Real estate refers to land and all properties and other permanent structures on it. It also refers to one of the largest and most lucrative industries with money-making opportunities for investors and professionals seeking work. Notably, information is crucial when working in real estate, investing, or simply buying and selling property. As such, research, learn, and stay updated on new developments.

[…] mortgage payments, leading to the lender seizing the property. A foreclosure property is a house or real estate that has been repossessed by the lender due to the owner’s default on the loan payment. These […]

Your article helped me a lot, is there any more related content? Thanks!